Getting My Non Profit Org To Work

Wiki Article

Little Known Facts About 501c3 Nonprofit.

Table of ContentsThe Single Strategy To Use For Google For Nonprofits3 Easy Facts About Non Profit ShownGetting My Not For Profit Organisation To WorkSee This Report about 501c3 NonprofitThe Best Strategy To Use For Not For Profit OrganisationThe Ultimate Guide To Non Profit Organization ExamplesThe Ultimate Guide To 501c3 Organization8 Simple Techniques For Non Profit

Unlike lots of various other kinds of contributing (via a phone telephone call, mail, or at a fundraiser event), donation web pages are highly shareable. This makes them perfect for raising your reach, as well as for that reason the number of contributions. Donation web pages enable you to collect and also track data that can educate your fundraising method (e.An Unbiased View of Nonprofits Near Me

donation size, when the donation was contribution, who donated, gave away muchJust how a lot they exactly how to your website, site) And so on, lastly pages contribution it convenient and hassle-free for your donors to benefactors!You could additionally consider running an email project with regular e-newsletters that allow your visitors learn about the wonderful job you're doing. Be certain to gather email addresses and also other relevant data in an appropriate means from the start. 8. 5 Take care of your people If you haven't taken on employing and onboarding yet, no fears; now is the time - 501 c.

501c3 Organization Things To Know Before You Buy

Here's how a nonprofit previously owned Donorbox to run their project as well as obtain contributions with a straightforward yet well-branded page, optimized for desktop and mobile - non profit. Selecting a financing design is critical when starting a not-for-profit. It relies on the nature of the not-for-profit. Below are the various sorts of financing you may want to take into consideration.As an outcome, nonprofit crowdfunding is grabbing the eyeballs these days. It can be made use of for certain programs within the organization or a general contribution to the reason.

During this action, you may want to assume regarding turning points that will indicate a chance to scale your not-for-profit. Once you have actually operated for a little bit, it's essential to take some time to assume concerning concrete growth objectives.

The Ultimate Guide To Not For Profit Organisation

Without them, it will certainly be hard to assess as well as track progression in the future as you will have absolutely nothing to gauge your outcomes against as well as you won't know what 'effective' is to your not-for-profit. Resources on Starting a Nonprofit in various states in the United States: Starting a Not-for-profit Frequently Asked Questions 1. Just how much does it set you back to start a nonprofit company? You can start a nonprofit company with a financial investment of $750 at a bare minimum and it can go as high as $2000.How much time does it require to establish a not-for-profit? Depending on the state that you're in, having Articles of Consolidation authorized by the state government may occupy to a couple of weeks. Once that's done, you'll have to get acknowledgment of its 501(c)( 3) condition by the Irs.

With the 1023-EZ type, the handling time is usually 2-3 weeks. Can you be an LLC and also a nonprofit? LLC can exist as a nonprofit restricted responsibility company, nonetheless, it ought to be entirely had by a single tax-exempt nonprofit company.

4 Easy Facts About Non Profit Organizations Near Me Shown

What is the distinction between a foundation as well as a nonprofit? Foundations are generally moneyed by a family members or a company entity, yet nonprofits are moneyed via their incomes and fundraising. Structures typically take the cash they started with, spend it, and after that distribute the cash made from those financial investments.Whereas, the added money a nonprofit makes are made use of as operating expenses to fund the company's goal. Is it difficult to start a not-for-profit company?

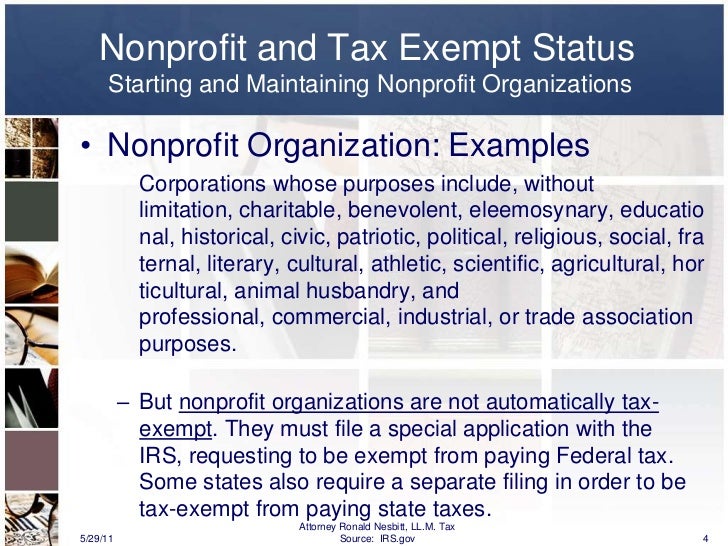

There are a number of actions to begin a not-for-profit, the barriers to access are reasonably couple of. Do nonprofits profit organizations examples pay taxes? If your not-for-profit earns any earnings from unassociated tasks, it will certainly owe revenue taxes on that amount.

The smart Trick of 501c3 Organization That Nobody is Discussing

The function of a nonprofit organization has always been to develop social change and lead the way to a much better globe., we focus on remedies that help our nonprofits enhance their contributions.Twenty-eight various types of not-for-profit companies are acknowledged by the tax obligation law. But by much one of the most usual sort of nonprofits are Section 501(c)( 3) companies; (Section 501(c)( 3) is the part of the tax code that licenses such nonprofits). These are nonprofits whose objective is charitable, spiritual, instructional, or clinical. Area 501(c)( 3) company have one substantial advantage over all various other nonprofits: payments made to them are tax insurance deductible by the benefactor.

This category is necessary because exclusive foundations are subject to strict operating regulations as well as policies that don't put on public charities. Deductibility of payments to a private structure is a lot more minimal than for a public charity, and also exclusive structures are subject to excise tax obligations that are not imposed on public charities.

The Only Guide for 501c3

The bottom line is that exclusive foundations obtain much worse tax therapy than public charities. The main difference between exclusive foundations as well as public charities is where they get their financial backing. An exclusive foundation is normally managed learn the facts here now by an individual, household, or corporation, and also acquires a lot of its earnings from a few benefactors as well as financial investments-- an excellent instance is the Bill as well as Melinda Gates Foundation.Most foundations simply offer cash to other nonprofits. As an useful matter, you require at least $1 million to begin a personal structure; otherwise, it's not worth the trouble as well as expense.

The Ultimate Guide To Non Profit Organizations Near Me

If the IRS categorizes the nonprofit as a public charity, it straight from the source maintains this status for its very first 5 years, no matter of the public support it really receives during this time around. Starting with the not-for-profit's sixth tax year, it has to show that it fulfills the general public assistance examination, which is based on the support it gets throughout the present year and also previous 4 years.If a not-for-profit passes the examination, the internal revenue service will continue to monitor its public charity condition after the first 5 years by calling for that a finished Arrange A be filed each year. Figure out even more concerning your not-for-profit's tax status with Nolo's book, Every Nonprofit's Tax obligation Overview.

Report this wiki page